From the web site of the LONDON EVENING STANDARD:

Triple business rates increase 'is putting small traders at risk'

Nicholas Cecil and Mirand Bryant

28.10.09

Ads by Google

Council Tax Reclaiming

Martin Lewis' system to get £1000s A free 10 minute check of your band

ServersPlus IBM Partner

Buy Servers from the IBM Business Partner 09 for high quality service

Contractor Pay

Contractors can take home up to 88% from contract work safely

Small firms face being driven to the wall by a "triple whammy" of business rate increases, MPs were warned today.

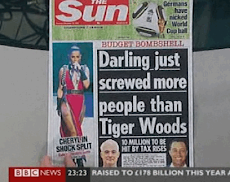

Mark Field, Conservative member for Cities of London and Westminster, accused Chancellor Alistair Darling of seeking to "plunder" businesses and treating them like "cash cows".

In a Commons debate, Mr Field highlighted the impact of three tax moves:

* The five per cent increase in business rates this year.

* The business rate revaluation, which will come into effect in April next year.

* The levy being imposed to raise £3.5 billion for Crossrail.

Mr Field told MPs today: "Many firms will have to absorb a triple whammy of taxation. Companies in my constituency are being plundered to such a degree that I fear their success is being taken for granted. With trading conditions so tough, such a level of taxation could scupper the city's fragile economy."

He said that with a revaluation of last year's property rental values, the average business rates bill in Westminster is expected to soar by 38 per cent next year. The move would rake in an extra £456 million for the Treasury.

While the revaluation aimed to be fiscally neutral, many firms in the capital would lose out because of the high rental values before the recession. Mr Field said a very big Oxford Street store would face an estimated £3 million rise in business rates for 2010/11. For a small firm in Soho the figure would be £1,500.

Meanwhile, companies with a rateable value of more than £50,000 have to pay the Crossrail levy.

Mr Field said increased valuations would also push about 3,500 more Westminster companies above that threshold. One Soho trader, Richard Piercy, 47, who owns Zest Pharmacy in Broadwick Street, said: "My shop has been here since 1950 so is a real part of the community. I love working in Soho but I'm very worried by these huge business rate increases.

"It's unfair that we shoulder the burden for the rest of the country.

"It's a ruinous formula. Along with any rent review that will bring us into line with ludicrous rates paid in the boom years, many businesses will face a very uncertain future."

Ministers say London is getting transitional relief to lessen the impact of the rates shake-up. The capital will get £935million out of £2billion of transitional funding available, the Department for Communities said.

In outer London, just over half of firms would pay lower rates as a result of the reforms, by an average of £950.

A spokesman added that companies are also being allowed to delay paying 60 per cent of this year's business rate increase. Firms will be able to spread the payment over the next two years.

We're being used as short-term cash cow'

Tim Bryars, 35 Antique map and book seller, Cecil Court, off Charing Cross Road

Mr Bryars said his business rates bill of £4,325 had risen to £7,696 for this year, and would rise a further 30 per cent in April.

“Instead of supporting small businesses, government is using them as a short-term cash cow. And it is very short-term, because soon those businesses will be gone.” He said two map shops had already shut and “I'm worried we won't be able to survive”

Holly Andrew, 36, Pall Mall Printers and Stationers, Royal Opera Parade, Covent Garden

Miss Andrew said her business rates were £6,500 per year — almost half her rent — and could rise by up to 38 per cent. “It worries me because my rent is already very high and the rates make it higher. I do old-fashioned printing, which has demand here. A shop like this needs to be here. If all the little shops were sent out of London it would make it a very empty town.”

Sunday, November 1, 2009

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment