0648 Hrs GMT

London Friday 5 June 2009

KHOODEELAAR! Evidential note on the economics of health, as updated in a research report due to be published in the USA.

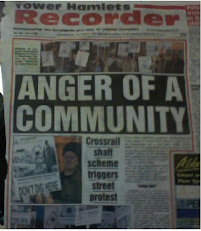

One of the main demands of the KHOODEELAAR! campaign against the Crossrail hole agenda has been that the planned attacks on the health of the community will have overall adverse effects.

Although the point is simple and logical, the task of getting this across to the Crossrail agenda inviters has not been as simple.

______

ScienceDaily (June 5, 2009) — In 2007, before the current economic downturn, an American family filed for bankruptcy in the aftermath of illness every 90 seconds; three-quarters of them were insured. Over 60% of all bankruptcies in the United States in 2007 were driven by medical incidents. In an article published in the August 2009 issue of the American Journal of Medicine, the results of the first-ever national random-sample survey of bankruptcy filers shows that illnesses and medical bills contribute to a large and increasing share of bankruptcies. The share of bankruptcies attributable to medical problems rose by 50% between 2001 and 2007. Following up on a 2001 study in 5 states, where medical problems contributed to at least 46.2% of all bankruptcies, researchers from Cambridge Hospital/Harvard Medical School, Harvard Law School and Ohio University surveyed a random national sample of 2,314 bankruptcy filers in 2007, abstracted their court records, and interviewed 1,032 of them. They designated bankruptcies as "medical" based on debtors' stated reasons for filing, income loss due to illness and the magnitude of their medical debts. Using identical definitions in 2001 and 2007, the share of bankruptcies attributable to medical problems rose by 49.6%. The odds that a bankruptcy had a medical cause were 2.38 fold higher in 2007 than in 2001. According to the study, a number of circumstances propelled many middle-class, insured Americans into bankruptcy. For 92% of the medically bankrupt, high medical bills directly contributed to their bankruptcy. Many families with continuous coverage found themselves under-insured, responsible for thousands of dollars in out-of-pocket costs. Out-of-pocket medical costs averaged $17,943 for all medically bankrupt families: $26,971 for uninsured patients; $17,749 for those with private insurance at the outset; $14,633 for those with Medicaid; $12,021 for those with Medicare; and $6,545 for those with VA/military coverage. For patients who initially had private coverage but lost it, the family's out-of-pocket expenses averaged $22,568. Because almost all insurance is linked to employment, a medical event can trigger loss of coverage. Nationally, a quarter of firms cancel coverage immediately when an employee suffers a disabling illness; another quarter does so within a year. Income loss due to illness was also common, but nearly always coupled with high medical bills. Writing in the article, David U. Himmelstein, M.D., states, "The US health care financing system is broken, and not only for the poor and uninsured. Middle class families frequently collapse under the strain of a health care system that treats physical wounds, but often inflicts fiscal ones." "This study provides further evidence that the US health care system is broken," according to James E. Dalen, M.D., M.P.H., University of Arizona College of Medicine, Tucson. "Medical bankruptcy is almost a unique American phenomenon, which does not occur in countries that have national health insurance. These long-time advocates of a single payer system give us another compelling reason to work toward this goal as a nation." Journal reference:Over 60 Percent Of All US Bankruptcies Attributable To Medical Problems

See also:

No comments:

Post a Comment