0945 Hrs GMT

London

Wednesday

08 July 2009:

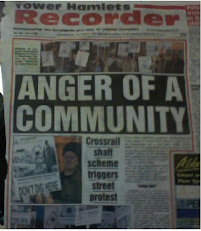

KHOODEELAAR! Told you so! That one of the three main pillars of lies on which the hype for London Crossrail has been built in the past feverish years, to the effect that it was VITAL for the alleged financial competitiveness of London [note the word ‘London’ here, rather than the ‘City of London’] as compared with Paris [and even New York, and may be Tokyo and any number of alleged other ‘rivals’], was a sham.

Was a lie. Was a totally criminally irresponsible assertion. That lie has been most recently uttered by Ken Livingstone making an appearance on the ‘edit’ page of the London EVENING nostandards STANDARD.

We describe the London EVENING nostandards STANDARD as 'nostandards’, as having nostandards whenever we find it carrying any aspect of the lying Lyinsgtone garbage about economics. Livingstone is not reliable at all on economics.

In fact his ignorance of economics has been shown in a massive, overwhelming way by the collapse of the fantasy about the financial capitals that we have witnessed in the past year.

Yet the London EVENING nostandards STANDARD keeps providing a platform for him to peddle the same old lie.

Even though the lie has been nailed completely and comprehensively by the evidence of the past 12 months.

We have said in the past 5 years and 6 months that Livingstone has lied for Crossrail and that he has done that with the complicity of the London EVENING Nostandards STANDARD.

We noted a few months back the alleged change of management at the same title. In fact at least two incidents of historic moment in the context of the campaign against CRASSrail have been noted.

The ‘new’ management has actually allowed two comments from KHOODEELAAR! to be published on the EVENING STANDARD web site.

This was not allowed to happen in the previous years.

We are now saying that the EVENING nostandards STANDARD is reversing back to the grip of the USA Military industrial Complex member BECHTEL. We have noted that Bechtel was identified by the very Establishment and the very Right-wing management of the London PRIVATE EYE itself.

They [PRIVATE EYE, 'edited' by the increasingly Royal Box-occupying Ian Hislop] admitted that Bechtel played the key role in getting the Crossrail Bill rubber stamped by the UK Parliament. They [PRIVATE EYE] also said that that had been done by the use of a former aide to Douglas Alexander.

Who is Douglas Alexander? He is another ex, occupying the Crossrail Department for Transport portfolio in Gordon Brown’s cabinet, now occupying another post in the same G Brown’s hyped-up cabinet. Douglas Alexander has not denied the report in PRIVATE EYE.

Nor has Bechtel. Nor has Alexander’s former aide acting as the de facto puller of the power-strings inside the Palace of Ghostminster. Private Eye did not use the descriptive Palace of Ghostminster. It is a descriptive and analytical expression devised by KHOODEELAAR! movement….

Nor has any of Alexander’s successors at the UK Daft department FOR Transport [=DfT] denied Private Eye’s significantly published admission…It is almost a year ago that the Crossrail Bill WAS RUBBER STAMPED INTO THE Crossrail Act.. And almost as long since PRIVATE EYE published that assertion…

We have not seen or heard or been aware of any contradiction of PRIVATE EYE’s original report. We here ask the current occupant at Daft, Andrew Adonis, to deny that report.

While waiting for Adonis to seek due advice on this, we can say again that Canary Wharf is irrelevant to London’s alleged attractiveness [that morality-free term has been used in Ken Livingstone's lying language] as a competitive financial centre… As we refer here to an admission by another CrossRail peddling outlet, the London Financial Times, admitting that the hype for Canary Wharf Crossrail has been crass as well… As shown by NOMURA group ‘abandoning;’ Canary Wharf in favour of the ‘Square Mile’..

-------

By Megan Murphy, Investment Banking Correspondent Published: July 7 2009 19:53 | Last updated: July 7 2009 23:45 Watermark Place, the 525,000 sq ft glass and steel building that Nomura, the Japanese investment bank, has chosen as its European headquarters, offers sweeping riverside views, easy transport links and enviable proximity to London’s top social and cultural attractions. Since global companies first began forsaking the Square Mile for Docklands in the early 1990s, the two districts have waged a fierce battle over which is the preferred location for the 325,000 well-paid employees who work in London’s financial services industry. And while executives at both the Canary Wharf estate and the City of London Corporation are keen to emphasise the complementary nature of the two hubs, there is no doubt that Nomura’s move is a much-needed boost for the latter, which has struggled with falling rents and rising vacancy rates in the wake of the credit crunch. “We’re certainly delighted to welcome them back to the City,” said Stuart Fraser, head of the corporation’s policy and resources committee. Senior executives at Nomura, which bought the European operations of Lehman Brothers last year after the Wall Street bank collapsed, were known to be keen to abandon Lehman’s sludge-green carpeted premises in Canary Wharf. Nomura’s decision to sign a 20-year lease at Watermark Place, which is due for completion in 2010, marks a fresh start for a company that is seeking to transform itself from an Asia-focused investment bank into a global group with a strong UK base. The traffic, however, is still moving both ways. JPMorgan, the US-based investment bank, announced plans in November to move its headquarters from the City to Canary Wharf, while Bank of America is said to be debating leaving its Docklands space for the plush City offices of Merrill Lynch. The “City versus Canary Wharf” debate has long prompted strong feelings among bankers, many of whom will have switched between the two several times during their careers. Financiers who tend to cluster in pricey neighbourhoods such as Knightsbridge, Chelsea and Notting Hill frequently complain about the lack of transport options to Canary Wharf, which is served mainly by the Jubilee line and the Docklands light railway. Disruption on either route can cause chaos. Getting to Heathrow or Gatwick airports for a long-haul international flight also remains a challenge, at least until the long-delayed Crossrail link is running. Others bemoan the comparatively sterile atmosphere of “the wharf” when pitted against the charms of the Square Mile’s winding streets and its centuries-old drinking dens. But to many others, Canary Wharf’s easy-to-navigate layout and broad range of bars and restaurants make it a more attractive, less stressful place to work. The estate’s developers have worked hard over the past few years to improve its atmosphere at night. Many of its venues are now jammed late into the evening. “When I was younger I used to work in Lower Thames Street and I did appreciate romantic things in the City like Leadenhall Market,” said one top banker. “Now I can’t be bothered.” Copyright The Financial Times Limited 2009City-Docklands rivalry flares up

Yet more crucially for senior management, it offers a blank slate for it to build a global investment bank in a prime City of London location, moving the bank closer to its clients than its competitors, most of which are based a few miles down the Thames in Canary Wharf.

Yet more crucially for senior management, it offers a blank slate for it to build a global investment bank in a prime City of London location, moving the bank closer to its clients than its competitors, most of which are based a few miles down the Thames in Canary Wharf.MORE IN THIS SECTION

[To be continued]

No comments:

Post a Comment