0250 [0228] GMT

London

Monday 25 January 2010.

Editor © Muhammad Haque.

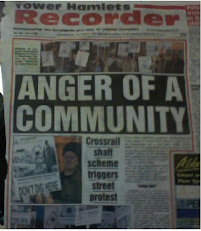

The Khoodeelaar! diagnosis of Big Biz Crossrail scam is AGAIN vindicated de facto by the London Financial Times. Crossrail and the 2012 Games Hosting scam, says the FT in effect, are providing the UK construction business rare and badly needed business.. [Updater 1] The London ‘FT’ has AGAIN confessed to the fact that the 2012 Hosting and Crossrail are ABOUT Building contracts. And that they are the main projects providing ‘respite’ to the building industry which has undergone the most contraction in ‘business’.

This confession again vindicates the Khoodeelaar! Diagnosis that we have made and published daily about CrossRail and only to a smaller extent about the 2012 Games Hosting scam.

The London Financial Times []=‘FT’] web site is deceptive. Its URL addresses OFTEN don't lead to articles that area supposed to be accessible through the addresses. So for evidential purposes only we publish the full texts of that piece which the following URL originally yielded but then failed to show it later when we tested the link for verification:

http://www.ft.com/cms/s/0/997e2d0c-0951-11df-ba88-00144feabdc0.html

Tough times ahead as the gloom lingers on

By Sharlene Goff

Published: January 25 2010 02:00 | Last updated: January 25 2010 02:00

The construction industry is in a grim mood as the economy emerges from the downturn, with public spending cuts adding to pressure on levels of building activity that are already historically low.

The industry was the single biggest contributor to redundancies during the recession. Now, after a slump of 12 per cent in output last year - the sharpest fall since records began in 1955 - a further 3 per cent contraction is forecast this year.

For some contractors, government-funded infrastructure projects have been a boon during the past 18 months, as residential and commercial development dried up.

There is, however, concern that, whichever party triumphs at the election, the industry will be hit by lower investment in schools, hospitals and transport infrastructure in the next few years.

Housebuilders have joined the chorus of contractors and building materials groups predicting that 2010 will be a difficult year, with low levels of mortgage availability.

Furthermore, while the market improved slightly during the second half of 2009, the Royal Institution of Chartered Surveyors this month said the number of properties sold was still a third lower than the start of 2007.

Repair and maintenance have offered a rare bright spot for building groups, while big projects such as the Olympics, Crossrail and the widening of the M25 will continue to provide much-needed contracts.

However, even the most optimistic predictions do not foresee a recovery for the sector until early 2011.

Ed Hammond

The effect of the downturn will continue to be felt by aerospace companies for some time.

British Airways, the flag carrier that relies on business class travellers for a big portion of its revenues, reported record losses last year as business and first class traffic slumped by as much as a fifth in February 2009, compared with the same month a year earlier.

Conditions have improved since, but first and business class traffic is still down and Willie Walsh, chief executive, has warned that business travel may never recover.

Low-cost carriers such as EasyJet, fared much better.

Andy Harrison, EasyJet chief executive, was able to boast late last year that his was one of the few European airlines to remain profitable over the previous 12 months. He confirmed last week that the airline was still on track to "deliver substantial profit improvement in 2010".

Airbus, the European aerospace manufacturer that employs more than 9,500 people at its Filton and Broughton plants, has shown resilience so far, thanks to a backlog of more than six years' worth of work amassed during the boom years.

Pilita Clark

The pharmaceutical industry has so far emerged relatively unscathed from the domestic downturn in the UK, although broader global pressures are likely to take a toll.

Multinational groups do not split out sales for the UK, although revenues have been protected - as in many developed countries - because medical services are largely funded by government, and the importance of health to individuals helps support spending.

Paradoxically, the weakness of sterling against the euro in recent months means some UK pharmaceutical subsidiaries have been able to book higher revenues in the local currency, as intermediaries have brought drugs priced more cheaply for resale elsewhere in Europe.

However, structural processes under way in the sector even before the downturn mean a reduction in jobs in the UK, with fewer sales staff required and pressure growing for cost-cutting in manufacturing and other divisions.

Two big US mergers last year - Pfizer with Wyeth and Merck with Schering-Plough - also led to cuts in UK staff.

The prospects of ever- tighter budgets could add other constraints. More broadly, the NHS has refused to pay for a handful of innovative high-priced but relatively low-volume drugs, notably for cancer. Red tape, slow recruitment and high costs are also still driving clinical trials abroad. That could mean diminished investment in research and development in the UK.

Andrew Jack

Banks were at the epicentre of the downturn, and while many have staged recoveries faster than expected, they are likely to suffer some of the most severe and enduring consequences.

Regulators around the world are introducing rules that will constrain the amount and type of business that banks and other financial institutions can do. In the UK, they will be forced to hold more capital and a greater proportion of liquid assets. They are also

facing tougher tax measures.

This will increase the cost of doing business - the most secure and liquid assets tend to generate low returns - restrict trading, particularly around riskier but potentially lucrative investment banking activities, and curb their ability to grow.

Retail banks will face a tougher time as limited access to wholesale funding means they will have to push up saving rates to attract retail deposits.

Banks' ability to lend will also be constrained by the requirements to keep a higher capital buffer.

Banks that have been bailed out by the government are taking action to shrink their balance sheets. Royal Bank of Scotland and Lloyds Banking Group are cutting back their activities while a number of building societies are also retrenching.

The financial sector has previously contributed about 8 per cent to the UK's gross domestic product, according to Capital Economics. The research consultancy believes this could drop to 6-7 per cent over the next few years.

Sharlene Goff

Britain may be a nation of shopkeepers but it is also a nation of shoppers. Such people helped retailers in the downturn, with tills ringing more than anyone would have imagined this time last year.

Consumers who have kept their jobs have seen their spending power boosted by low mortgage costs and energy bills, while increases in food prices moderated throughout the year. Shoppers were also simply fed up with being fed up and treated themselves over Christmas. These factors were epitomised by John Lewis, which enjoyed a record festive season.

Store groups that survived the bloodbath before Christmas 2008 were also able to pick up sales from defunct rivals worth £14bn, according to retail research group Verdict.

However, many senior executives fear this year could be much tougher, with the pain expected in 2009 put off until 2010.

No comments:

Post a Comment