0220 GMT

London

Tuesday 26 January 2010

Editor © Muhammad Haque

Boris Johnson v Will Hutton

Is London's banking system a vital cog that keeps the capital running, or a timebomb in the British economy? Let the debate begin...

Dear Boris

Banks must be one of the most effective lobby organisations in modern times. You probably saw the recent IMF paper "A fistful of dollars; lobbying and the financial crisis", which showed the more a bank spent on lobbyists, the riskier its lending. You are allowing yourself to be used as a wholly owned lobbyist of the British Bankers' Association and the Corporation of London – and if and when the balloon goes up again with another financial crisis, you will be left high and dry.If Britain allows its banking sector to grow as rapidly over the next decade as in the last, with so much of its revenue diverted not to building up its capital but to paying extravagant bonuses, when the next crisis comes it will overwhelm the British state.

We could just about get through this crisis with £1.3 trillion of liquidity, guarantees and capital injections into the banks. Next time round – in five or 10 years' time if nothing changes – Britain simply could not pay the bill. We would have to print money or endure an even deeper recession, and that will include Londoners.

Andrew Haldane, executive director of the Bank of England, calls it a "doom loop".

Of course we want a vibrant banking sector in London, but we also need it to be sound. For more than a decade, banks and investment banks have got used to paying out routinely up to 50% of their revenues as bonuses. As the Bank of England says, if they had paid just 20% less in bonuses and dividends between 2000 and 2008 they would have had £75bn more capital – more than the taxpayer put in. They must change in future.

Tax on bonuses is part of a much bigger story, of trying to create a sounder banking industry. Bankers may think there is some escape – but to where? Smaller financial centres like Singapore or Hong Kong lack the economic muscle to support big banks when things go wrong, so depositors will vote with their feet. The banks' business will dissolve.

There is nowhere in the EU with a better infrastructure or regulatory/tax framework kinder than London's. And President Obama has announced a 10-year levy on banks because of their "obscene" bonuses – hardly friendlier than here.

You are being taken for a ride. We may lose a few bankers as the sector shrinks, which is what happens in capitalism when businesses make mistakes. But instead of defending the indefensible, why not be on the side of a sounder banking system and a more diversified London economy – a great legacy as mayor?

Best, Will

Dear Will

Oh come off it. You ask how I have been somehow conned into sticking up for London banking. I do so for the same reason that I fight for any other sector.I defend financial services for the same reason that I have championed the London Living Wage, given cut-price travel to jobseekers, frozen City Hall's council tax and built 20,000 affordable homes in the last 18 months. I will fight for the interests of Londoners who work in banking for exactly the same reason that I fight for the interests of those who work in tourism or the media or in public transport. I do so because I sincerely and passionately believe it is in the interests of London. Of course I deplore, like you, the current orgy of excessive bonuses – and in case you think I am just saying this to suit an Observer readership, let me direct you to an article I wrote in that proud capitalist organ, the Daily Telegraph, on 19 October. In fact, let me quote a chunk of the concluding bombardment: "The decision of these banks to hand out these bonuses as though nothing has changed is unbelievable. The only reason these bankers are still in jobs is because the taxpayer bailed out the system.

"These banks can no longer talk glibly about the need to offer competitive salaries to star bankers, and the operation of the free market. Their irresponsibility almost brought the free market crashing to its knees. How can they pretend that the world hasn't changed? What blindness, what deafness, what Asperger's afflicts them?"

And I went on to warn the banks that if the bonus bonanza continued, and if they continued to seem so heedless of wider society, then the pressure for fiscal retaliation would be overwhelming. I was proved right, of course, and the issue now is not whether banks will face new taxes, but to what extent these measures can be globally concerted so as not to disadvantage London.

I agree with you, by the way, that an international accord should oblige the banks to insure themselves against the consequences of their risk-taking. We must somehow end this implicit taxpayer guarantee that makes the current bonus round so outrageous.

But if I read your letter correctly, that is not enough for you. Oh no. You want to go further. You actually want to "rebalance" the British economy by an unspecified process of shrinking or pruning the financial services industry.

You want a "more diversified" London economy. This may or may not be a good thing, but I am not sure how you achieve it. The financial services industry contributes about 9% of GDP, and every job in the sector is estimated to add £117,000 to the London economy.

The taxes generated by the hedge funds and private equity alone are enough to pay for 200,000 nurses or 165,000 teachers or the entire Olympic budget. How else are you going to find that money, Will?

And what about all the London families and individuals who depend more or less directly on the wealth and energy of the City? What about the lawyers and the accountants and all the other professions involved in the deals? What about the builders and the taxi drivers and the waiters?

What do you say to all these millions of people when you brilliantly decide to sabotage one of the main flywheels of the London economy?

What do you say to your friends in the arts world when their operas and their galleries are no longer able to call upon the philanthropy of these despised masters of the universe?

Suppose you were to accomplish your Pol Pot-style purge, and remove – say – one banker in 10. Which sectors do you think would miraculously sprout to fill the gap? I don't think you have a clue, and certainly no evidence for thinking that these people would pop up in, say, manufacturing.

Perhaps you would prefer more people became journalists or the heads of think tanks. As even the Work Foundation [of which Hutton is the executive vice chair] may be about to discover, there is a limited amount of taxpayers' money to fund endless studies into this or that, and it's no way to run an economy.

London is blessed with a world-beating industry that is of colossal importance to the UK economy. We are agreed that the present bonus round is a huge own goal. We are agreed that the system needs reform. But to set out to attack the City of London, to reduce it in scale, to diminish its share of GDP, in the delusive hope that some other sector will supplant it in a "more diversified" economy – that strikes me as positively barmy.

Best, Boris

Dear Boris

Swashbuckling stuff – but which Boris am I debating with? There is Boris A, the D'Artagnan of the City, firing off letters to the chancellor about the impact of the bonus tax and warning of thousands of bankers set to leave London. Then there is Boris B, the wise financial statesman worried about bankers' orgy of excessive bonuses, and the need for reform. Here we make common cause.But the financial statesman reverts to D'Artagnan with a blink of an eye. Since we began this debate, Obama has raised the stakes massively with his proposal to stop banks running trading desks where they speculate in so-called derivatives, or owning and sponsoring private equity groups and hedge funds to whom banks have lent hundreds of billions of dollars.

Obama has reversed three decades of financial policy making, and struck at the pyramid of securitised lending, with its interconnected credit default swaps and derivatives.

I support his move – together with banks carrying more capital and paying an insurance levy, I think the banking system could be made a great deal safer, and the intolerable risk of taxpayers picking up the bill while insiders walk away with grotesquely high bonuses will be greatly reduced. Do you agree?

But this has big implications. Blowing the whistle on pseudo profits and the accompanying bonuses is not a "Pol Pot" weeding of the ranks of City employees. British bank assets doubled in the decade to 2007 as the capital underwriting them fell and they exploited regulatory holes they'd lobbied for. That can't happen in the next decade, or if it does, as I repeat, the next crisis could overwhelm the economy.

Putting this right is not barmy – it is correcting what has become a tax on the rest of the economy. That figure of £117,000 for every City job you use takes none of this into account. Do the economists who produced the estimate assume that the alternative for talented people working in the City is unemployment or making zero economic contribution, which would be pretty unlikely? Do they net out the cost of bailing out banks? We've ended up with too many banks, lawyers, estate agents and the like – and not enough hi-tech companies, designers, advertisers, software houses, health companies and all the other opportunities out there.

We have too little productive entrepreneurship generating jobs and wealth beyond financial services. It now puts London at risk. I applaud your support of the London Living Wage and cut-price travel for job-seekers, but you could go even further. How about launching a London network of "Johnson" institutes whose job is to scan the horizon for new scientific and technological ideas and connect them with dynamic young companies who don't have the resource to do such scanning themselves? George Osborne has talked about developing banks that are more supportive of business. How about a London Business Bank? Health is becoming a boom area; how about getting behind London's great teaching hospitals to promote and entrench London as the leader in world health? I don't think it's barmy to think in these terms. I suspect Boris B doesn't either. But what about D'Artagnan Boris A?

Best, Will

Dear Will

I had got most of the way through your latest when it suddenly hit me that you may not even be aware of the basic shape of the London economy. Of course everyone is obsessed with bankers and their bonuses.Everybody wants to bash them and to bash anyone so rash as to defend their very existence. But what you seem to ignore is the many other London sectors that are globally dominant and which seem – on the face of it – to be completely out of scale with our population. London not only has four of the world's six largest law firms. We have more of the world's top universities than any other city, with two of the top five, and with billions in revenues from foreign students that are crucial for the higher-education economy.

We have a huge creative, culture and media sector, with 30% of the UK workforce and a bigger advertising industry than New York. We have the biggest constellation of medical science centres outside America, a stunning treasury of intellectual riches.

And yes, since you ask, I met representatives of the three key players – King's, Imperial, UCL – last October, and we agreed that our new Promote London Council would make medical science a central part of the message to the world. We have the biggest tourist industry of any metropolis, with more visitors than either New York or Paris – which is not surprising since we have twice as many bookshops as New York and more museums than Paris, and, oh yes, it rains more in Rome.

Now let me ask you: do you believe that any of these gigantic London sectors are somehow "too big"?

Is it a "tax on talent" that so many bright minds are drawn to teach at London universities, so that we have become the Athens of the modern world, with foreign fees pouring in to subsidise the impecunious natives?

Would you say that those who work in our tourism industry are somehow generating "pseudo-profits"? Of course you wouldn't. You don't disapprove of people coming here to make millions from London's thriving and cosmopolitan film industry, do you?

You wouldn't want to kick some of them out, or reduce the number of movie millionaires. So why are you so determined to make London less attractive for financial services and to reduce the number of bankers?

You are making two fundamental mistakes: first, in thinking that London is entirely dependent on financial services, when that is plainly not true. Second, you seem to imagine that London's financial services industry should be somehow "proportionate" to the rest of the London economy, with each limb – manufacturing, media, transport, whatever – assembled with the harmony of some ancient statue.

That is to misunderstand what London is, and the role it plays in the world. Financial services are part of a global industry, and 75% of London's banking and insurance products are sold overseas.

Ever since we got rid of the anti-enterprise mentality of the 1970s, London has been a global talent magnet. My worry now is that we – or rather you and the Labour government – are starting to sound hostile to the kind of wealth creators who have come here in the last 25 years, attracted by our energy and our diversity and what used to be our fairly low tax rates.

I repeat: Obama is right to say the banks need reform, though it is hard to know what he means when he says he wants to stop retail banks doing proprietary trading "unless it is necessary for customer services". That seems a fairly large loophole.

I agree that we need a healthy banking sector, and I repeat that these outlandish bonuses should not be given with the luxury of a taxpayer guarantee. But what I don't understand is your seemingly implacable desire to shrink banking for the sake of it, to stop people going into it and to corral them into other professions. I feel I need to know the psychological origins of this rage against the kulaks.

Is it not time Observer readers had the full backstory of banker-bashing Will Hutton?

Best, Boris

Dear Boris

We've just lived through one of the most frightening and dangerous periods of British economic life since the early 1930s. British banks – with loans five times our national output, which was on a near Icelandic scale – were days away from collapse. New Labour had presided over a bubble economy stimulated by the banks who were making pseudo, illusory profits.The aftermath – rebuilding sound banks, unravelling the hundred of billions of now largely worthless loans, consumers rebuilding their savings, lowering unemployment and getting public finances back in order – will take a decade. And it was an avoidable disaster.

I welcome that we agree the case for reform – yes, let's close down any loopholes in Obama's proposals. This is what you're suggesting, isn't it? Because when I make the case, you accuse me of banker-bashing, shrinking banking for the sake of it, etc, etc. You say you want sounder banks; but you recoil from the consequences – throwing invidious charges around like confetti but trying to dodge any flak yourself. It is not a lovely sight.

I am keenly aware of London's strengths beyond banks which I celebrate too, and of the structure of the London economy. But over the past decade London became disproportionately dependent on financial services. The difference between London's global pre-eminence in cultural and creative industries, health and universities and its pre-eminence in finance is that none of those have the same capacity to grow what amounted to gigantic pyramid selling schemes or ask for trillion-pound cheques when things went wrong. Capitalism is the best system yet devised to generate wealth. But when it gets too unfair it becomes dysfunctional, which is what we have witnessed. It is what I want to put right. It would be great if a politician with your flair for expression shared that aim – and its consequences.

Best, Will

Dear Will

Let me give you an example of why we need a London banking sector that is big, dynamic and willing to experiment with new products. The recent cold weather has driven households to spend huge sums on heating, in many cases more than they can afford. It is more urgent than ever, therefore, to help people install the measures – the lagging, the insulation – that can so dramatically reduce bills and, of course, reduce emissions of CO2. The trouble is that these measures are expensive. There are long-term savings, but there may be big upfront costs. Where do you go when you have a big upfront cost but an excellent prospect of recouping it over time? You go to a bank.We want the banks to help us come up with a financial instrument that will allow Londoners to retro-fit their homes. I want London to be at the heart of green banking, so that we create jobs not just in retro-fitting but in the financial services that make retro-fitting possible. We think the numbers look good for the banks. On the buildings that City Hall has retro-fitted, we will make money in eight years. But of course there is a risk. Perhaps – though it seems unlikely – world energy prices will collapse, and take the saving out of retrofitting. The key thing is the risk should be borne by the bank.

As you rightly say, Will, the problem we face now is not so much the initial crisis as the consequences of our response. Those banks took demented risks, and though a couple went down the tubes we bailed the rest of them out. Which means they all know in their heart of hearts that they can do it again. And we agree that it is outrageous that the current round of bonuses is made possible by a taxpayer guarantee. But the solution is not to demolish the banks. The solution is to ensure that if a greedy, bonus-hungry, testosterone-fuelled banker takes a stupid risk – then he cops it, or his bank cops it, and not the taxpayer.

That is why we need these people to insure themselves. Of course I accept that if this reform is mishandled it may damage the sector and lead, as you suggest, to significantly more job losses. Where we differ is in the way we would view such an outcome. You actively want to reduce the size of the banking industry, your former employer, dear Will. You relish the prospect of some sort of retribution, after the boom years of "pseudo-profits". I reject that concept.

These bankers didn't just invest in catastrophic sub-prime mortgages. By lending money at risk, they made possible every betterment of the human race from the iPod to new treatments for Alzheimer's. Those weren't pseudo-breakthroughs. And the staggering sums they pay in taxes – that isn't pseudo-money. Those weren't pseudo-lunches they bought and those weren't pseudo-jobs they generated in everything from building to IT to piano lessons.

London's financial services industry is big because London happens to have a large share of one of the most complex, fast-growing and intellectually challenging industries in the world. That is a tribute to the inventiveness of Londoners and the attractions of the city, and I am proud to defend it.

Best, Boris

Ads by Google

MSc in Investment&Banking

Top Masters Degree, Expert Tutors Elite London Business School

Overseas Payments for £1

Save money on international transfers. For UK Businesses only.

Top 10 Bank Accounts UK

Compare & Apply 40 UK Bank Accounts - Savings - Current Accounts - ISAs

Comments in chronological order (Total 200 comments)

Boris. " Let me give you an example of why we need a London banking sector that is big, dynamic and willing to experiment with new products". This is no more than some stupid out dated fantasy.

- Recommend? (59)

- Report abuse

- Clip |

- Link

The proper function of banks is to arrange credit, provide cash handling and payment transfer facilities, and safe custody of deposits.

The proper purpose of credit is to facilitate production, for example to enable the farmer to buy seeds and support himself until the crop is harvested and sold, when the credit is extinguished. Provided that the ancient prohibition on usury is adhered to, there is no problem. Bankers can be paid for their professional services and risks can be insured, and thus there is no necessity for the charging of interest on such credit.

Banking goes wrong initially when the activity turns into a machine directed primarily to making money for its own sake, and the fundamental professionalism of bankers is degraded and thought of as a market, selling financial "products".

It gets worse when credit is given for the purchase of land, or of "assets" which comprise mostly land, since this credit cannot be the cause of any production since the land was already there. Such credit is nothing more than a release fee to an owner for permssion to use the land. Worse still is when bankers absorb themselves in the practice of lending money for land purchase on the security of land titles, since the lending policy of bankers has the cumulative effect of driving up land prices (though not the real value of land, its rental income stream), thereby generating the kind of self-feeding bubble that occured in the run up to 2008, and the current bubble in "asset prices" which it is most probably the consequence of Quantitive Easing and will in due course collapse even more disastrously.

In conclusion - banking, practised properly and professionally in accordance with the ancient principles that govern such things, is a great blessing. When bankers lose their integrity and forget their fundamental principles and professionalism, it is a curse.

- Recommend? (147)

- Report abuse

- Clip |

- Link

London doesn't need Hutton or Johnson

- Recommend? (6)

- Report abuse

- Clip |

- Link

From what i read Boris seems to confine his remarks on the banking sector to the subject of bonuses probably knowing that this is the populist issue although obviously its not the key issue, i think he doesnt really know much more on the subject and as a bit of a lightweight as far as content goes will wait and see what the big guys do (obama) before adjusting to whatever wind direction happens to arrive and correcting his own wind (of which he seems to produce rather a lot and as such might be a potential renewable energy source) to follow suit. A political (right wing) sheep in wolfs (mavericks) clothing.

- Recommend? (33)

- Report abuse

- Clip |

- Link

making money from money is wrong, it even says so in the bible. So there.

- Recommend? (28)

- Report abuse

- Clip |

- Link

Bankers, don't we love them. Politicians, they are wonderful too. Politicians and journalists discussing the future for banking, what a wonderful confection. And when election day passes, when the owner of No10 is busy polishing his nice brass knocker and admiring his reflection in the deep blackness of the door, who will be out on the streets dealing with the outcomes of "expert knowledge" in the management of our economy?

For so long we have all been shuffling debt onto credit cards and banks that it seems there is a collective memory failure over one main issue; debt has to be paid.

- Recommend? (13)

- Report abuse

- Clip |

- Link

Boris - not the paper tiger described by the left.

Unlike Ken, he's stuck to his promises; banished the disastrous bendy buses, scrapped the western extension of the congestion charge ('consulted' by Ken and then its democratic vote ignored). Best of all, Boris has offended the Chinese at the handover of the Olympics, simply being scruffy and barmy and British.

Boris's idea that the bankers will 'help' Londoners through steep fuel bills in a tough winter is downright barking, however. Au contraire, they'll see it as an opportunity to charge us through the nose.

The widely pedalled Tory concept that London/UK needs banking to generate national income is also hokum. The only people that benefit from the banking sector are upmarket gymns, upmarket wine bars/restaurants, and the invisible cleaners on minimal wage over whom the city boys and girls step in the morning on their way to their offices.

The truth - as almost any Londoner will attest - is that the banking sector is a big fat leech, sucking on the lifeblood of the capital, contributing nothing to its financial and cultural lifeblood beyond buying a few corporate boxes at Chelski.

- Recommend? (69)

- Report abuse

- Clip |

- Link

No surprises here.

Boris is just doing what every tory has done since this financial disaster hit.

It's just the usual pretence that the environment which gave rise to that disaster was not a tory creation and in direct accord with the ideology of the tory party since the late 1960's.

An ideology they were still pushing practically hours before the rotten house of cards came tumbling down

(witness the boy George and his idiotic comments about the need for even less regulation of the mortgage market).

Sadly we just see the dodge and spin as they pretend otherwise but the fact is that the British economy is so horribly exposed to this ruinous situation because the tory party spent the longest and best years of the oil money 're-balancing' our economy away from actually making things to sell (with only the prop of 'foreign inward investment' to make much renewal in that area at all) to this foolish over-dependency on the 'financial sector'.

Labour were forced to accept the ludicrous nonsense that Thatcher/Reagan and Co. had 'won the economic argument'.

We were also regularly treated to the cries of 'control freakery' every time this Labour Gov attempted to impose the feeble regulations they did enact.

Thankfully the international excuse is being closed off thanks to Obama and a more clear sighted economic policy (in parts at least) originating in the USA.

With luck we will get similar and the Tobin tax to end the threat 'our' financial sector has over the nation right now.

Too big to fail is, quite rightly, just too damned big - and sensibly now being seen as simply all the necessary invitation to require breaking up.

Not only that but we've seen the manner in which they responded after sucking up vast public funding (funny how certain types of welfare are just fine and dandy) and guarantees they stick their middle finger up and attempt to carry on almost exactly as before.

Fool us once etc etc.

Never again!

- Recommend? (125)

- Report abuse

- Clip |

- Link

Mmm

That one didn't really go anywhere, did it.

And I'm still waiting for a decent article on exactly what we need to do with the financial sector that prevents the level of taxpayer exposure we have experienced, but without shooting ourselves in the foot by trashing what has been a significant source of tax revenue in the past.

- Recommend? (17)

- Report abuse

- Clip |

- Link

I can't help but be struck by how spiteful Boris manages to sound when his words are removed from the context of the bumbling and affable persona. He seems all too happy to resort to ad hominem arguments and make assumptions as to someone one else's beliefs and motivations, pouncing upon minor points without making any effort to appreciate the general sense of what is being said.

I genuinely (if I suspect vainly) hope that such personality traits aren't what lie beneath the modern Tory party as a whole. It makes the supposed desire for consensus building of the likes of Cameron and Johnson even more implausible.

Not looking forward to May...

- Recommend? (65)

- Report abuse

- Clip |

- Link

When will the penny drop that there are three sorts of 'growth'-----beneficial, benign, and malignant?

Basic banking is beneficial.

Genuine (i.e. for reason) 'investment' and 'hedging' banking is benign.

'Investment' and 'hedging' banking just in the hope of making a quick profit on price changes is just like any other form of gambling-----it is malignant.

Let it go unchecked and it will consume its host.

- Recommend? (113)

- Report abuse

- Clip |

- Link

Boris admits there is a problem but the only solution he has come up with is to write an article in the Telegraph (for which he receives an absurd and disproportionate 'compensation package', hypocrisy much?), a message to bankers that could be summarised as 'Come on chaps, that's just not cricket'.

We know that doesn't work.

The rest is just pointless waffling.

- Recommend? (48)

- Report abuse

- Clip |

- Link

The taxes generated by the hedge funds and private equity alone are enough to pay for 200,000 nurses or 165,000 teachers or the entire Olympic budget.

How many nurses and teachers could we have paid for if we didn't have to bail out the banks?

If the banking sector was a business it would be bankrupt. It made decent profits for a few years, paid massive dividends and wages , then lost an absalute packet without any way of paying it's debts. It would be dead, gone, history.

If half of them want to sod off to Singapore then good riddance.

- Recommend? (74)

- Report abuse

- Clip |

- Link

I get the distinct impression that Will Hutton is speaking from study and experience. My next impression is that Angela Knight (Chief Executive of the British Bankers Association.) is sitting directly behind Boris Johnson. No doubt lucrative non executive roles in the world of banking await one of these men. My money is not on Mr Hutton.

- Recommend? (81)

- Report abuse

- Clip |

- Link

Boris , like Goldman Sachs hasn't quite understood what is going on politically. his attempts to make Will Hutton look like a communist are childish and the use of a pol-pot allusion is downright unprofessional and distasteful.

Personally, if he said that to me and I met him at a public function he'd have to run. Kudos Will for not responding.

- Recommend? (87)

- Report abuse

- Clip |

- Link

What on earth possessed Londoners to vote for Boris? Was it a facebook joke that got out of hand?

- Recommend? (93)

- Report abuse

- Clip |

- Link

The slave trade kept many people in jobs, created wealth in this country for some and, I am sure, fostered a lot of "innovation" in its own perverse way. The mafia sets up businesses that employ people, which pay taxes and which are completely legit. Are these good arguments for not disturbing their activities?

- Recommend? (61)

- Report abuse

- Clip |

- Link

Other than the financial sector, Britain doesn't really have any other large viable industrial sectors left. One wonders where the country would be if it didn't even have banks and insurances to attract investment. You can't really keep a whole country afloat on Madam Tussauds and Stonehenge. Without London, the whole country would be well and truly scuppered.

- Recommend? (7)

- Report abuse

- Clip |

- Link

Hutton by an innings.

- Recommend? (52)

- Report abuse

- Clip |

- Link

Dispel any fantasies you may have that Obama will prove victorious over the banksters in the US. See this link for details:

http://rawstory.com/2010/01/bankers-way-around-the-financial-reforms/

The moral of the story is that these sharks are not fit to be allowed to control our destinies any longer. The world is changing dramatically and dramatic changes are needed to address the changing reality. The status quo is no longer a viable option.Get your thinking hats on...

- Recommend? (18)

- Report abuse

- Clip |

- Link

That is a fine and interesting post physiocrat

- Recommend? (13)

- Report abuse

- Clip |

- Link

And please don't tell me that tertiary-education is a growth sector in the UK. Accepting tens of thousands of state-school rejects from China and rich underachievers from developing countries every year will cripple this industry well before we start making lists again in December 2019.

- Recommend? (12)

- Report abuse

- Clip |

- Link

I think asking whether the Banking sector is too big is not really relevant. The issue should be about what it does. Most people have no issue with traditional banking in all its multifarious guises whether in support of domestic or foreign trade or industry.

However I believe some people might have qualms about such activities as packaging up self-certified mortgages sold to people without work on a low entry cost basis for two years and then sold to gullible ex-Building societies as high yielding bonds with triple A ratings and then taking bets with other institutions that the aforementioned products would fizzle and burn and destroy the aforementioned institutions so that they have to be rescued by credit created from taxpayers' new indebtedness.

There is the whole issue of principal trading especially when it involves meddling in markets such as oil, never mind registered stocks. In the first place institutions should be debarred from gambling if they take deposits at all. There is also the issue of whether it is appropriate that institutions should be able to game the markets on a short term basis when those markets exist primarily as a means of raising risk capital for new and expanding companies and a means by which savers can build their own future security or a means by which the producers and users of materials can trade. Why should they be in competition with people whose financial horizons can sometimes be measured in microseconds? So much of what is going on in so called investment banking is quite simply adding costs to legitimate market users: there is no more added value in what they do than there is in coin clipping.

So why not regulate what the banks can do? The way to stop excessive bonuses is to remove the scope for financial gain where no added value is created. The City of London does employ many highly talented people. however it is arguable that many of the highly talented people would be capable of creating genuine added value if suitably employed and that some of the people working in the City are vilely greedy and pathologically dishonest and the criminal code needs to catch up with their various scams with some very heavy penalties indeed..

- Recommend? (27)

- Report abuse

- Clip |

- Link

Now let me ask you: do you believe that any of these gigantic London sectors are somehow "too big"?

The one that costs taxpayers £1.3 trillion when it goes tits up is too big.

- Recommend? (71)

- Report abuse

- Clip |

- Link

Boris seems to demolish his own argument in pointing out all the other economic activity going on in London, which as Will Hutton suggests, has plenty of potential to fill any gap left by a smaller but more fit-for-purpose finance sector!

Boris

The taxes generated by the hedge funds and private equity alone are enough to pay for 200,000 nurses or 165,000 teachers or the entire Olympic budget. How else are you going to find that money, Will?

It's a complete fallacy to measure the value of an industrial sector by its tax contribution. Its value depends on how it uses resources to produce 'socially useful' output.

Will

That figure of £117,000 for every City job you use takes none of this into account. Do the economists who produced the estimate assume that the alternative for talented people working in the City is unemployment or making zero economic contribution, which would be pretty unlikely? Do they net out the cost of bailing out banks?

Absolutely spot on. There are opportunity costs, and there are 'opportunity benefits'. Better but smaller banks would produce plenty of the latter.

Boris

I agree that we need a healthy banking sector, and I repeat that these outlandish bonuses should not be given with the luxury of a taxpayer guarantee.

This looks suspiciously like a get-out clause. But it won't work. There will always have to be state guarantees for the banking system, explicit and implicit.

- Recommend? (51)

- Report abuse

- Clip |

- Link

The equation is wrong. The free market can't only control the economy on the way up and when it crashes hand it over to the state. We certainly can't do away with a capitalist system, but the financial sector needs to be regulated in such a way so that when it messes up next time it isn't left to the state to clear up the shit.

Bonuses and profits should go straight into R&D, so they have the knowledge and financial instruments to save themselves, and us, in future.

- Recommend? (15)

- Report abuse

- Clip |

- Link

Dear Boris,

Have you grasped the basics of financial capitalism? Bankers do not create wealth. They speculate with others money at the expense of thousands more. The win-win scenario does not exist and "green banking" will never exist in a system called capitalism which is fundamentally opposed to conserving the finite resources of the world.

- Recommend? (41)

- Report abuse

- Clip |

- Link

Wow. Is Will Hutton out to lunch?

I don't know what debate you other commenters were reading, but Boris won this one. And I'm not saying that as a tory. I agree with WH, so I'm left wondering why he didn't make his case effectively. Where were the numbers? This charge that the London financial sector is disproportionate needs to be backed up with figures. Boris argued with concrete examples, Hutton with vague claims. Get back into shape, Will!

- Recommend? (20)

- Report abuse

- Clip |

- Link

It's a complete fallacy to measure the value of an industrial sector by its tax contribution. Its value depends on how it uses resources to produce 'socially useful' output.

Correct.

At an extreme, if all you've done is lifted money out of other people's pockets, then no matter how much of that money you pay as tax, your overall contribution is zero.

- Recommend? (38)

- Report abuse

- Clip |

- Link

It's a complete fallacy to measure the value of an industrial sector by its tax contribution.

Not when you have a government that defines itself by how much money it spends. If not for the City, then who's going to pay for all that social engineering and pet projects? No-one on the left has yet been able to explain that.

- Recommend? (5)

- Report abuse

- Clip |

- Link

London's financial services industry is big because London happens to have a large share of one of the most complex, fast-growing and intellectually challenging industries in the world.

I suppose an industry that needed the best part of one trillion pounds domestically to shore it up against collapse could be described as "fast-growing" from a certain point of view.

- Recommend? (30)

- Report abuse

- Clip |

- Link

agree with WH, so I'm left wondering why he didn't make his case effectively. Where were the numbers? This charge that the London financial sector is disproportionate needs to be backed up with figures. Boris argued with concrete examples, Hutton with vague claims. Get back into shape, Will!

I don't agree actually, but i know where you're coming from. He's been much better refuted in this thread than by Will Hutton.

That, i'm convinced is part of Boris' success. His opponents always underate him, and don't really bother to think when they're up against him.

This was also the true secret of George Bush's carreer. His enemies always thought he was dumb, so they could beat him easy.

- Recommend? (5)

- Report abuse

- Clip |

- Link

deano30

24 Jan 2010, 1:35AM

Hutton by an innings.

Hutton was 3 nil up by half time plus had two dead cert shouts for a penalty turned down by the ref. He just played keep ball in the second half as the crowd chanted oooh laaay!!!!!

Boris seems to have lost the dressing room.

- Recommend? (18)

- Report abuse

- Clip |

- Link

Investment bankers are out of control and a world unto themselves. The only shocking thing here is how long it's taken the majority to wise up. Many have known about the vacuousness of the 'City' for decades but no one listened.

The problem isn't just deregulation it goes far deeper than that. The problem is when you have individual organisations controlling more money than some countries GDP's. It's impossible i'd argue for any CEO to responsibly track that many transactions yet the quantities demand he does so.

These banks need to be smaller and leaner. 10,000 Investment banks is better than 15 behemoths. Imagine if the internet only had a couple of dozen websites?

It's the same with supermarkets, car production, and the media. More smaller companies is better than a few super large ones. The hollow macho culture of making it into the FT100, and then acting as if 'anything goes' after that has to stop. Almost all these companies were by and large fantastic innovative until they reached a critical size. Power falls into far too few hands, and there's an incentative to form cartels which mostly go undetected and competition is stiffled.

The corporate acquisitions and 'mergers' always get approved because armies of lawyers, and accountants are hired to overwhelm and befuddle government adminstrators who earn much less money with the governments own laws and rules and because lobbyists are paid to bride politicians. There's no rational reason to approve these mergers because they bring no long term benefit. So stop doing it.

The arguement you need to be big to fund the cost of evolving your product and services is false. The internet proves time and time again small organisations can come together and achieve big breakthroughs and share the spoils. Banks and other large organisations can learn much from how the web works. But they don't because the think the internet is facebook, porn, and twitter. They could learn how 21st century ebusinesses combine inclusiveness without being anti-enterprise. Competiveness without obstructionism is possible.

Then Boris will be happy to because he can have as many banks as he pleases but they'll all have to play fair because there'll be so so many of them it will lead to self policing and if some of them go belly up it will be like a modest ripple on the surface of an ocean.

We the customers would be happier too and feel less like cattle.

- Recommend? (37)

- Report abuse

- Clip |

- Link

Will Hutton is clueless and almost a Communist.

Finance is one of the few industries that the UK is any good at.

- Recommend? (12)

- Report abuse

- Clip |

- Link

It's fairly simple, banks can engage in risky lending if they have the reserves to cover their losses. Maybe a tiered system of reserves should be implemented. Create various levels dependent on what level of risky behavior a bank decides to get itself into. The higher the level of risk, the higher their reserves must be.

It's easy to seem to make money when one is only plundering the business. That is what the bankers did. Pay gross bonuses then cry when the shit hits the fan. Surely one of the jobs of a banker is to make sure the future is secure. If they did not see this bubble was going to burst they should be in another profession, because they are idiots.

- Recommend? (8)

- Report abuse

- Clip |

- Link

As Vince Cable and others said at the time of the crisis, and since, banks got too big to fail. In a free market system that cannot and should not be allowed to happen.

The State now has an unprecedented stake in British banks. It should use that stake to ensure that the retail or high street banking, and the riskier investment banking arms of these goliaths are split into smaller units.

Governments should not say a particular industry is too big or too small or anything else. But they should set down clear rules on regulation and tax. And in a free market, competition and choice are important if the public are to be well served.

In the recent crisis, speculation on rising property prices was driven by banks lending irresponsibly, making apparently huge profits and awarding large bonuses along the way. They got greedy, or stupid or both and we're all paying the price. Having bailed these people out because they were "too big to fail", we want to be sure that it won't happen again.

So give us a banking industry that is competitive, serves the public and provides the investment capital to rebuild our industry. To the general public, the term "banker" is a dirty word just now and with good reason. True, it's been an important arm of British commerce for a very long time. But it's got too big for its boots.

Bring banking down to size. Make it competitive and let it show it can serve its customers and the general public. And we need banks that are not too big to fail. No one is indispensible, not even bankers.

- Recommend? (25)

- Report abuse

- Clip |

- Link

Politicians, like Boris, Gordon and Obama, are in a difficult spot. They know who their true masters are but they also know that the public is furious. They have tried to do absolutely nothing about what created the biggest financial crisis since 1929 but the banksters are not playing their part when they can't even wait a year before giving themselves bonuses that are equivalent to the GDP of a small country. That is why politicians are appalled, absolutely appalled. But that does not mean that they want to actually do anything about Casino banking, apart from gimmicks.

So what should have been done to limit the risks of casino banking to the world economy ? Here are my suggestions:

1. The first thing to do is to kick out all politicians who believe that the finance industry can regulate itself.

http://www.pbs.org/wgbh/pages/frontline/warning/

2. At the bottom of the US pyramid scheme was the mortgage industry and its liar loans. Prosecute everybody involved in this massive fraud.

http://www.pbs.org/moyers/journal/04032009/watch.html

In the future it should also be illegal to provide mortgages to more than 60-80% of the value of the house.

3. Make naked Credit Default Swaps illegal.

http://dealbook.blogs.nytimes.com/2008/08/11/naked-came-the-speculators/

http://www.ft.com/cms/s/0/aa741ba8-0a7e-11de-95ed-0000779fd2ac.html

4. Regulate the rest of the CDSs as normal insurance.

5. Make naked short selling illegal.

http://dealbook.blogs.nytimes.com/2009/05/01/goodbye-to-naked-shorting/

6. Set strict limits on leverage in the financial industry. Lehman had an insane leverage of 44. It is the access to cheap borrowed money that is the main cause of the crisis.

7. The rating agencies which are paid by the companies they rate have completely failed. They put triple A ratings on CDOs that were absolute junk and this was another major reason for the financial crisis. Perhaps it is time to create public independent rating agencies.

8. Separate investment and commercial banking i.e. repeal the Gramm-Leach-Bliley Act.

http://en.wikipedia.org/wiki/Gramm-Leach-Bliley_Act

http://www.nytimes.com/1999/11/05/business/congress-passes-wide-ranging-bill-easing-bank-laws.html

9. Split up financial companies that are "too large to fail" by new stringent anti-trust legislation.

10. Close down off-shore taxhavens. Why do the UK allow crown colonies to become taxhavens so that the finacial elite can avoid paying taxes ? It does not even help the colonies.

http://www.guardian.co.uk/world/2009/sep/01/cayman-islands-tax-haven-bankrupt

11. Stop high-frequency trading.

http://dealbook.blogs.nytimes.com/2009/08/24/arrest-over-software-illuminates-wall-st-secret/

12. Tax casino banking much harder by for example a Tobin tax.

13. Do not allow pension funds to invest in hedge funds or complicated securities since they have shown that they are not capable of estimating the risk.

14. Outlaw financial instruments that have no value to society. For example the

new ideas of using life insurance instead of subprime in derivatives.

http://www.nytimes.com/2009/09/06/business/06insurance.html

15. Keep interest rates high enough to prevent new bubbles to form.

16. Change the "tax breaks for the rich" to "tax increases for the rich".

Any other suggestions ?

- Recommend? (28)

- Report abuse

- Clip |

- Link

I looked up Boris Johnson in the Roget's Thesaurus, and this is what I got:

ham,

hamfatter *[obs3]; masker[obs3]. pantomimist, clown harlequin, buffo[obs3],

buffoon, farceur, grimacer, pantaloon, columbine; punchinello[obs3];

pulcinello[obs3], pulcinella[obs3]; extra, bit-player, walk-on role, cameo

appearance; mute, figurante[obs3], general utility; super, supernumerary

buffoon, farceur[French], merry-andrew, mime, tumbler, acrobat,

mountebank, charlatan, posturemaster[obs3], harlequin, punch,

pulcinella[obs3], scaramouch[obs3], clown; wearer of the cap and bells,

wearer of the motley; motley fool; pantaloon, gypsy; jack-pudding, jack in

the green, jack a dandy; wiseacre, wise guy, smartass [coll.]; fool &c.

501.

I've put my favourites in bold.

- Recommend? (19)

- Report abuse

- Clip |

- Link

Finance is one of the few industries that the UK is any good at.

As recent events have demonstrated so wonderfully.

Er....... hang on a minute.

Are you INSANE!!!!!!!!?

- Recommend? (42)

- Report abuse

- Clip |

- Link

We need a Tobin tax. That would put a huge great dent in the problem.

I always thought Londoners were shrewd, tolerant people, capable of seeing through idiots. How the f-ck did they elect that bumbling, lazy buffoonish halfwit.

- Recommend? (25)

- Report abuse

- Clip |

- Link

For those who worry that stricter banking regulations and a Tobin tax will lead to an exodus of bankers from the UK -- then good riddance!

Such dependence on the financial sector has in this country has made its economy vulnerable to the swings of the market and has promoted income inequality. Without the financial sector to rely on, perhaps this country can focus on more productive, useful industries for its own people, and through exports, for those abroad.

- Recommend? (19)

- Report abuse

- Clip |

- Link

Yawn. Britain has no natural resources and is chronically overpopulated. Without the City it's gonna look like 28 Days Later. Really.

- Recommend? (6)

- Report abuse

- Clip |

- Link

The influence of the city on the economy, the much loved drip down effect serves to fuel useless luxury sector inflation. It makes this city too expensive for vast majority of its inhabitants and attracts way too many businesses that would have no chance in hell of surviving without the breadcrumbs from bankers' tables. Frankly, we do not need as many expensive hairdressers, luxury SPAs, gyms, cocaine dealers and swarms of estate agents.

I am not saying we should somehow pray all these people were simply to disappear or live in poverty. They are capable enough to soon find different ways of making profit for themselves and the treasury.

Britain (obviously) needs banking but the benefits to the whole country and society as a whole are not directly proportional to the size of the banking sector. Let's not shy from removing some of its flab.

- Recommend? (12)

- Report abuse

- Clip |

- Link

It continues to appall me that a Tory party so obsessed with the morality of poor people - whether it be marriage, work ethic or faith - can settle into this moral vacuum when it comes to big money.

I will never forget, having watched Piper Alpha go 'woof', the blessed Margaret sending her sympathies to Dr Hammer. Nothing changes.

- Recommend? (27)

- Report abuse

- Clip |

- Link

We have a huge creative, culture and media sector,

Got to agree with Boris there, St Ives in Cornwall would be a dead town without these fuckin parasites coming down every weekend.

- Recommend? (10)

- Report abuse

- Clip |

- Link

Boris,

meanwhile infrastructure falls apart, public transport grows worse and all you do is self-promote you blonde-haired blanc-mange.

"You want" you want you want the banks to do some absolutely Observer reader friendly stuff but will you do to make it happen except ask your old chums from Oxford days to try, please.

Will should be Mayor and you should stand with the rest of us waiting for the 19 bus and cursing your failure to bring back the routemaster.

- Recommend? (18)

- Report abuse

- Clip |

- Link

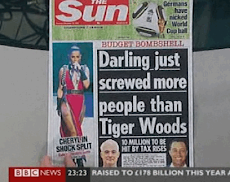

DAVID Cameron yesterday demanded IMMEDIATE public spending cuts - saying it is the only way to tackle the debt crisis left behind by "the Great Recession".

The Tory leader accused the Government of putting "naked political calculation" ahead of Britain's economic welfare.

Figures out today are expected to show Britain is officially out of recession.

But Mr Cameron said that "means nothing" without urgent action to tackle the £178 billion budget deficit.

He promised the Tories would impose cuts in an emergency budget if they win the election.

Mr Cameron said: "Our recession, the Great Recession, is the longest and deepest since the war and coming out of recession does not mean that our debt crisis is over.

"Far from it: Labour's debt crisis is now the biggest threat to our recovery, so we will only get this recovery right if we start now on a proper debt reduction plan."

Mr Cameron compared Government policy to using a personal credit card, saying: "The more we spend and the longer we wait to pay off our bills the worse it gets.

"We have just had the worst public borrowing figures for any December on record, we are borrowing money at the rate of around £6,000 every second - which means that every five seconds the Government borrows more than the average British person earns in a year.

"We are spending more money on the interest on our debt than on almost anything else."

Gordon Brown hit back, saying cuts this year would put the fragile recovery at risk.

The PM insisted other world leaders and the International Monetary Fund backed his view, and said support was growing for his idea of a global levy on bank deals - the so-called Tobin tax.

CBI chief Richard Lambert yesterday warned a whole generation of youngsters would have their life chances wasted unless the economy recovers - as experts said job satisfaction was plunging.

Read more: http://www.thesun.co.uk/sol/homepage/news/2824750/Tory-leader-says-we-must-cut-now-to-beat-debt-threat.html#ixzz0dgFNT95V

No comments:

Post a Comment